Company Background

Curnance was born from a simple but urgent insight: Finance in Africa is broken for too many — and too slow for too long.

Traditional banks serve the few, international payments are expensive, and accessing loans is near impossible for most people — especially young, underserved, or informal sector workers. Businesses, too, face complex hurdles managing cash flows, collecting payments, or scaling across borders.

Curnance was founded to fix this.

Built by a team of technologists, economists, and Pan-African visionaries, we designed Curnance to be more than a neobank.

Vision

To power a borderless financial ecosystem where individuals, businesses, and institutions across Africa and beyond can move money, access services, and build wealth — instantly, intelligently, and inclusively.

Mission

To democratize access to financial services across Africa by building a smart, secure, and borderless wallet platform that powers instant payments, inclusive banking, and intelligent financial tools for individuals, businesses, and institutions.

What Curnance Offers

Discover our suite of financial solutions designed for both individuals and businesses—empowering you to manage, move, and grow your money with confidence.

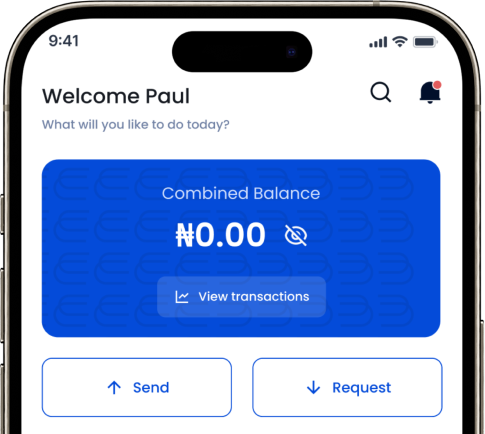

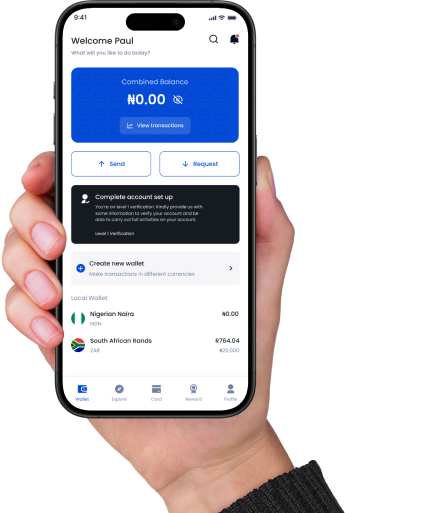

Empower Your Everyday Finances

Experience seamless payments, smart savings, and instant access to financial tools—built for your lifestyle, wherever you are.

- Instantly send and receive cross-border and local payments

- Pay tuition, rent, salaries, and bills in seconds

- Access smart loans and manage multiple wallet-based accounts

- Use stablecoins to lower the cost of international transactions

- Onboard to financial services without needing a bank visit

- Access AI-driven credit scoring and multi-currency support

Business Banking, Reimagined

Unlock powerful tools for your business or institution—manage payments, payroll, analytics, and more with seamless, secure, and scalable solutions.

- Institutional collections (e.g., student fees)

Collect payments efficiently from students, clients, or partners with automated tools.

- Embedded finance APIs for businesses

Integrate financial services directly into your products with robust APIs.

- Treasury and payroll tools

Automate payroll, manage cash flow, and simplify treasury operations.

- Smart wallets for corporates and cooperatives

Empower your organization with secure, multi-user wallets and advanced controls.

- Financial dashboards and analytics

Gain real-time insights into your business performance and make data-driven decisions.

- Blockchain-backed transparency for all transactions

Ensure trust and security with transparent, blockchain-powered transaction records.

Guided by Principles, Driven by Purpose

Our unwavering values shape every decision, product, and partnership—ensuring we build a borderless, inclusive, and empowering financial ecosystem for Africa and beyond.

Radical Simplicity

We remove complexity from finance, replacing friction with flow.

Borderless Thinking

We challenge limitations — across countries, currencies, and conventions.

User Empowerment

We design to put power in the hands of everyday people and businesses.

Trust by Design

Security, transparency, and accountability are at the core of every product we build.

Smart Innovation

We use emerging technologies like blockchain and AI to solve real problems, not just hype.

Inclusion First

From the unbanked to the global trader, everyone deserves a seat at the financial table.

Execution Excellence

We deliver. Fast. Efficiently. Relentlessly.